housing allowance for pastors form

0 2 METHOD 3. These can cost hundreds of dollars and are difficult to obtain.

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

Turbo Tax then correctly asks you how much you spent on housing.

. The total housing allowance payments can be reported in Box 14 which is simply an informational box for the employee. Most ministers and Pastors are considered employees of the church so you would report their compensation on a W-2with the salary reported in Box 1 and NOTHING in boxes 345 and 6. The next screen will ask you to enter the amount of your housing allowance.

Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now. Click on the Sign icon and make an electronic. Select the Federal taxes tab Business tab in Self Employed Online or TurboTax Home Biz Desktop.

Employers typically report housing allowances in box 14 Form W-2. Switch on the Wizard mode in the top toolbar to acquire extra suggestions. Select the orange Get Form button to start filling out.

For example suppose a minister has an annual salary of 50000 but. Fair rental value of house furnishings utilities. Housing Manse Parsonage Designation The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization.

Speak to a subject matter expert at the IRS. The housing allowance for pastors is not and can never be a retroactive benefit. According to Christianity Today 81 of full-time senior pastors take advantage of the housing allowance.

Housing allowances are not included in taxable wages in box 1. You may need to ask your treasurer for a corrected W-2. Complete Edit or Print Tax Forms Instantly.

Access IRS Tax Forms. You can also request an appointment online. Both are located on our website and mirror the forms in the back of the PCA Call Package Guidelines just follow the links below.

Box 1 is 37500 Box 14 is 2500. Its suggested that you validate this number by checking with a local realtor. This document is the ministers.

Edit Sign and Save IRS 8823 Form. Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now. However the pastor is required to include any excess housing allowance as income on their Form 1040.

Ad Web-based PDF Form Filler. Here we Have Everything you Need. Housing Allowance Worksheet I Manse.

If you have a clergy housing allowance. A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14. Ministers Housing Allowance Worksheet Approval The housing allowance amount is approved by the executive pastors signature via an annual compensation document.

Get the IRS to issue a private letter ruling regarding your specific situation. Heres a link to the form weve used for this purpose. In addition this is saving pastors a total of about 800 million a year.

From board of pensions as noted on IRS Form 1099R _____ 2-b Total officially designated housing allowance. Whether the pastor owns or rents a home it is essential that his or her. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes.

Fill each fillable field. The Ministers Housing Allowance is excludable from a pastors gross income for federal and state income tax purposes but not for self-employment tax purposes. You can go directly to the area to begin to enter your income and expense for your pastoral self employment.

Generally the housing allowance is reported in box 14 of the W-2 and is not included in boxes 1 3 or 5. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. If the amount the minister can exclude from income is less than the housing allowance include the excess as income on line 7 Form 1040.

How To Determine What Qualifies For The Clergy Housing Allowance There are only three ways to find out for sure if something qualifies. The minister must include the amount of the fair rental value of a parsonage or the housing allowance for social security coverage purposes. A worksheet is provided for the ministers use upon request.

No exclusion applies for self-employment tax purposes. Be sure the information you fill in Pastors Housing Allowances is updated and accurate. Social Security Coverage The services you perform in the exercise of your ministry are generally covered by social security and Medicare under the self-employment tax system regardless of your status.

If you have questions give us a call at 678 825-1198 to schedule an appointment with a Financial Planning Advisor. Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. Continue through the business interview and enter your 1099-MISC.

Include the date to the sample with the Date feature. If your salary is 37500 and the housing allowance is 2500 for a total compensation of 40000.

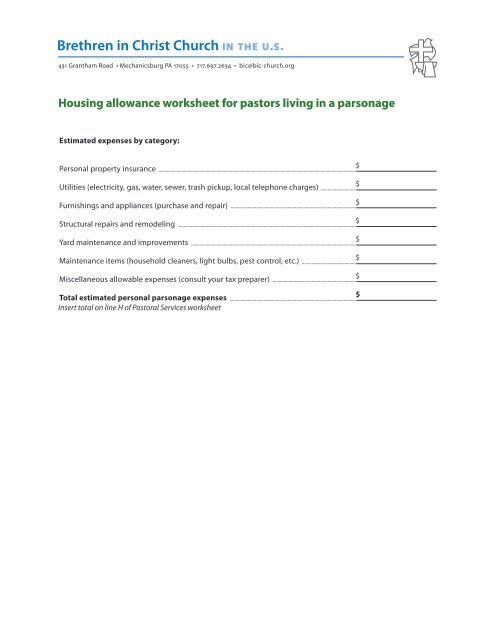

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Housing Allowance Request Form Brokepastor

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet The Pastor S Wallet

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

The Minister S Housing Allowance

Housing Allowance Worksheet Fill Online Printable Fillable Blank Pdffiller

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf

Pca Retirement Benefits Inc Housing Allowance Worksheet Fill And Sign Printable Template Online Us Legal Forms

Housing Allowance Request Letter Fill Online Printable Fillable Blank Pdffiller

Minister S Housing Allowance A K A Parsonage Allowance Pages 1 3 Flip Pdf Download Fliphtml5