new mexico solar tax credit 2020 form

Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1 2020 and has purchased and installed a qualified photovoltaic.

Affordable Solar New Mexico Areas Served Nm Solar Group

Ad Download Or Email PIT-1 More Fillable Forms Register and Subscribe Now.

. We last updated the Solar Market Development Income Tax Credit Claim F in March 2022 so this is the latest version of Form RPD-41317 fully updated for tax year 2021. In a disappointment to the solar industry the Congressional bill did not include a provision that would have allowed the Federal tax. See form PIT-RC Rebate and Credit Schedule.

54TH LEGISLATURE - STATE OF NEW MEXICO - SECOND SESSION 2020 INTRODUCED BY Mimi Stewart and Matthew McQueen AN ACT RELATING TO TAXATION. New mexico solar tax credit 2020 form Monday April 4 2022 Edit. New Mexico provides a number of tax credits and rebates for New Mexico individual income tax filers.

This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems. As of 112020 the first year of the tax reduction started with a 4 drop from the initial 30 credit to 26. The tax credit applies to residential commercial and agricultural installations.

General types of tax credits are. The bill states that a business or homeowner who purchases and installs a solar energy system on or after March 1 2020 are eligible for this non-refundable tax credit. EMNRD is in the process of reviewing the provisions in the amendments made to.

Note that the residential part of the Solar Tax Credit will be completely eliminated from 2022 onward while a 10 tax credit will remain for only industrial commercial and utility-scale projects. The federal solar tax credit. See below for forms.

Personal income tax credits. The credit disappeared for four years but was reinstated in 2020. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

The PIT-RC Rebate and Credit Schedule is a separate schedule to claim refundable credits. This area of the site summarizes New Mexicos business-related tax credits and the procedures for claiming them. This incentive can reduce your state tax payments by up to 6000 or 10 off your total solar energy expenses whichever is lower.

Energy Minerals Natural Resources Department EMNRD is no longer accepting 2021 New Solar Market Development Tax Credit NSMDTC applications. You can print other New Mexico tax forms here. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package.

The federal credit is in addition to New Mexicos solar state tax credit which was reinstated in March 2020. BE IT ENACTED BY THE LEGISLATURE OF THE STATE OF NEW MEXICO. You can download or print current or past-year PDFs of Form RPD-41317 directly from TaxFormFinder.

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. The balance of any refundable credits after paying all taxes due is refunded to you.

Homeowners throughout New Mexico can qualify for a 10 tax credit that gets applied to their state income taxes owed for the year the PV system is installed and commissioned. Applications for certification received after this funding limitation has been met in a calendar year shall not be approved NMAC 331410 C. CREATING THE NEW SOLAR MARKET DEVELOPMENT INCOME TAX CREDIT.

First come first served - the solar tax credit has an annual allotment of. For assistance see the New Solar Market Development Income Tax rule 3314 NMAC for personal income taxes or 3421 NMAC for corporate income taxes and other information available at the Clean Energy. SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM FORM Enter the credit claimed on the tax credit schedule PIT-CR or FID-CR for the personal income tax return Form PIT-1 or the fiduciary income tax return Form FID-1.

A new section of the Income Tax Act is enacted to read. The solar market development tax credit may be deducted only from the taxpayers New Mexico personal or fiduciary income tax liability. New Mexico state solar tax credit.

Ad Register and Subscribe Now to work on your NM Withholding Tax Form more fillable forms. Product reviews advice how-tos and the latest news - CNET. The state tax credit is equal to 10 of the total installation costs of your solar system up to 6000 per taxpayer per taxable year.

With an average system cost of 18760 in New Mexico most homeowners will get a credit of around 1876.

Battery Storage Capacity More Than Tripled In 2021 Pv Magazine Usa

Solar Panel Cost In New Mexico New Mexico Solar Group

Biden Extends Trump S Solar Tariffs With Key Exemption Time

Solar Energy For Farms Norwich Solar

Affordable Solar New Mexico Areas Served Nm Solar Group

Us Solar Hits Some Bumps In The Road Wood Mackenzie

Us Energy Storage Developers Plan 9 Gw In 2022 Building On 2021 Breakthrough S P Global Market Intelligence

Solar Panel Cost In New Mexico New Mexico Solar Group

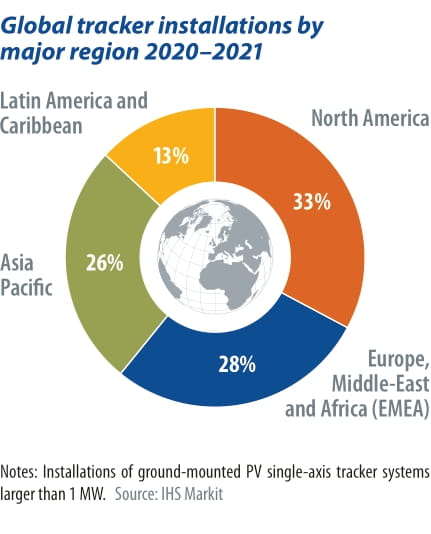

Global Tracker Shipments Reached 45 Gw In 2020 Pv Magazine International

Us Solar Hits Some Bumps In The Road Wood Mackenzie

Malaysia Korea And Vietnam Dominate U S Solar Imports W Chart Pv Magazine Usa

S Energy Solar Panels Sunshine Renewable Solutions Texas

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

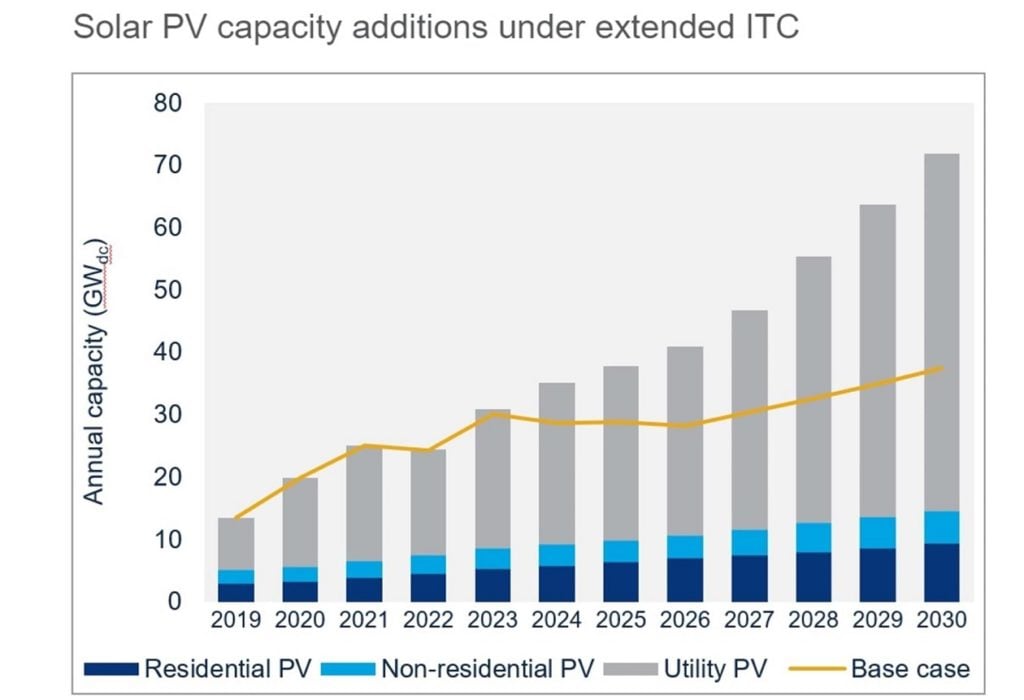

How Transformative Build Back Better Plan Could Supercharge Us Solar Sector Pv Tech